“I’m bootstrapping” or “I can’t afford marketing” is one of the top 5 reasons why startups don’t market their businesses effectively. These are legitimate drawbacks. But… there are healthy, scalable ways to market your business without busting your bank account. You just need to start seeing your marketing efforts in stages.

STARTUP MARKETING STARTS ASAP

The startup journey is pockmarked with anxiety about funding, scaling, development, and finding market fit. The struggle is real!

As I work with founders, many seem to put marketing in the same box as human resources or project management. It’s a department reserved for more established and revenue-positive companies. It’s seen as expensive, gratuitous, and near impossible to prove its effectiveness.

Q: Why, then, should fintech companies start investing in marketing early?

A: Marketing, along with branding, is foundational to every new business.

Your marketing strategy will answer these core questions:

- What problem is our product or service trying to solve?

- Who needs our product or service?

- Why do they need our product or service?

- How does our product or service transform the customer’s experience or life?

I bet that these questions guide your product development from day 1. Now you just need to put them under the marketing lens to build a scalable marketing strategy.

Stage #1: You have a product to sell (and market)

Whether this product is a prototype or in beta, if you have a product to sell then you also have a product to market.

Most fintech companies have a new and innovative product that requires a bit of explanation. All that product backstory needs copy and assets that explain what it does, who it’s for, and why it’s amazing.

Recommended Marketing Investment:

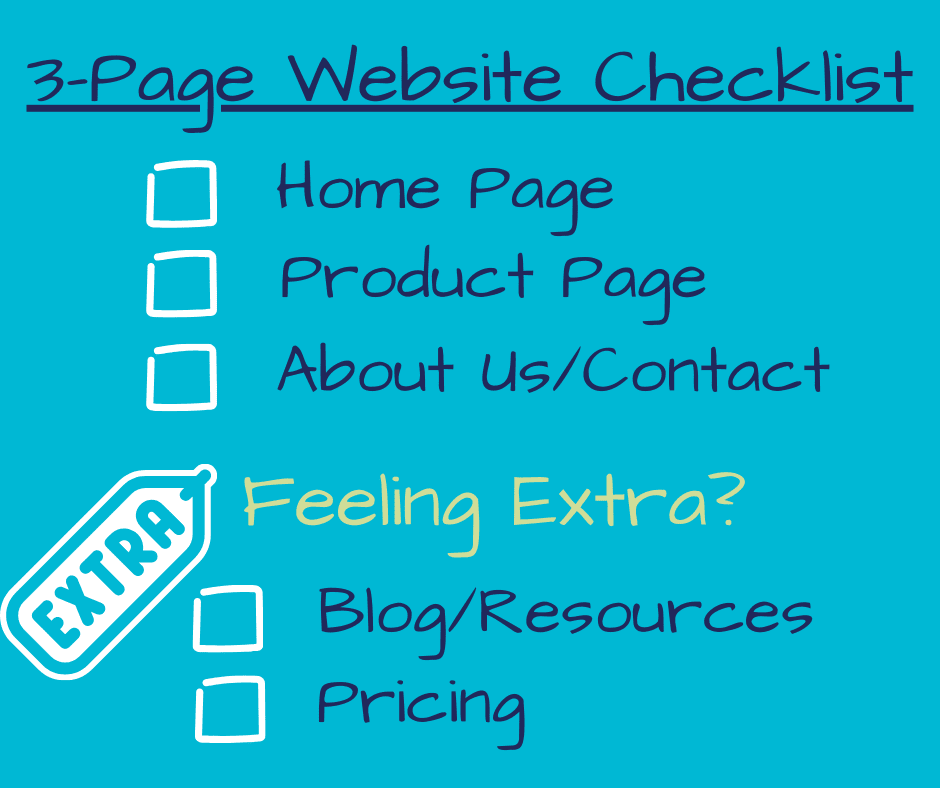

Web Copy: Every customer (whether B2C or B2B) will question the legitimacy of your company or product if you don’t have a website. If this product is your flagship product, you’ll want a 3 to 5 page website to introduce your company and product.

Building an email list: An email list is the best way to build a relationship with current and future customers. Unlike social media, there are no algorithms, hashtags, or other visibility games you have to play to be seen.

In the early stages, you can build a list full of interested early users or warm leads. Message them regularly with company and product information. As people receive (and read) your emails, they will trust you and keep you top of mind when they’re ready to make a purchase.

Branding strategy: The fintech market is crowded. The only way to stand out is by developing a clear, recognizable, and trustworthy brand. Your branding strategy dives into your company’s core values and will dictate how you do everything: product development, opening new markets, and interacting with customers.

Once you know who you are and what you offer, marketing that to customers becomes 10x easier.

Market research: What’s the difference between a fintech company that scales and grows or washes out? Product-market fit.

Market research includes things like customer interviews, reviews from a beta test, or pulling demographic data and trends. Save some time, money, and heartache by spending time doing market research before launching your product to the public.

If you do that you’ll have more confidence and social evidence as you release new products.

Content marketing (including social media): Think of your content marketing as a dating profile for your product. Buyers will check it all out before they think your product is worth a purchase.

Lots of stats agree with me:

|

That means you have to give them something to research and post that information in places they’re likely to see it.

Stage #2: You have a clear demographic to sell to

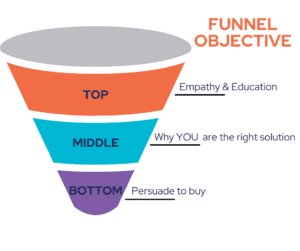

Let’s say your product has been battle tested. You’ve established there’s a need and a buyer base. Now it’s time to think about your funnel, or the pathway you design that persuades customers to buy.

There are a few ways to build a funnel and each strategy isn’t one-size-fits-all. Keep these principles in mind as you create these touchpoints with your customers.

Your Customer Funnel

- The top of the funnel is for customers who are totally unaware of what you do or if they even have a problem that you need to fix.

- The middle of the funnel is for customers who are shopping for a solution.

- The bottom of the funnel for customers who’ve done their research. They know who you are and what you offer.

Recommended Marketing Investment:

Email marketing: Once you have your list, you can start regularly contacting your potential and current customers with offers, insights, and product updates. The email frequency will depend on your bandwidth and customer appetite.

Successful email marketing strategies will be consistent, appropriately segmented, and on-brand.

Case studies: Social proof is the most convincing selling tool. It also helps to provide success stories to researching customers as it proves you can walk-the-walk.

These are straightforward to create, but do require an actual customer to feature. For startups, consider offering an incentive or gift to early adopters in exchange for a case study.

White papers: Highly effective education pieces when you are working with products and services in highly technical and regulated environments, like fintech. White papers are long-form content that build a case for a new or better solution than what is currently on the market.

This recent white paper from Visa is a great example.

Newsletters: Like email marketing, newsletters keep you in touch with your audience. You can use them to keep your audience up-to-date on your company news, industry news, product news, or all three.

Personally, the best ones I read are informational and entertaining.

Analytics: The only way you know if your funnel is working is to track metrics, like click-through-rate (CTR), average monthly visitors, impressions, shares, etc.

Match your tracked metrics to the performance indicators that are important to your company, knowing that they’ll probably change as you scale.

Stage #3: You’ve built up your client base

By now, you have a fairly predictable revenue stream, you know your customers and have built up a good working relationship with them.

And if you’ve been scaling your marketing efforts, your marketing know-how has also grown. This next stage is all about refining and leveling up the foundation you’ve spent months building.

Recommended Marketing Investment:

SEO: Technically, you can start working on this while you’re building your content library. In this staged approach though, you can use the extra money from your steady cash flow and marketing chops to be an SEO competitor.

Spend some time to review your current content assets. Make them SEO-rich with the keywords you know will attract your ideal buyers. Update relevant stats and content to show the search engines and buyers that you’re active and an industry leader. No crusty, stale blogs, please!

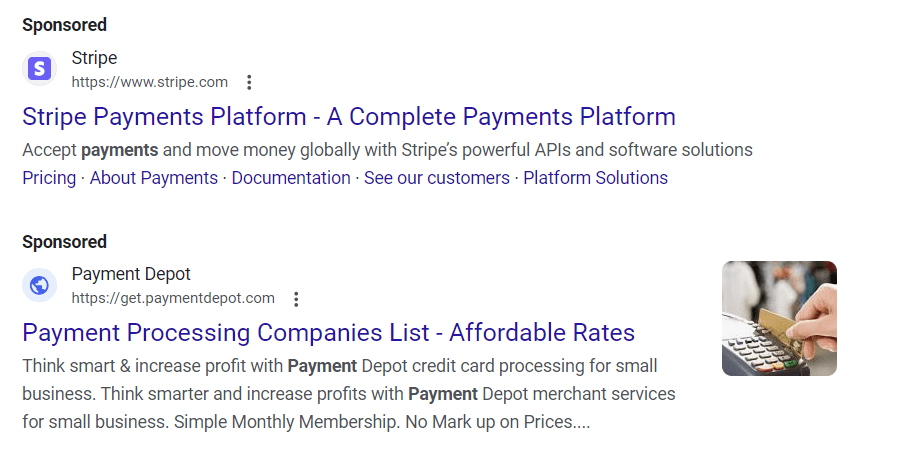

PPC Ads: This is paid search where you bid with other companies for the same keywords. The highest bidders will get a coveted spot on the first page as a sponsored listing. If searchers click on your link, you’ll pay the advertiser (probably Google) the bid price. Hence pay-per-click.

Website Revamp: A decent, startup website can cost between $5-$10K. A grade-A professional website can cost $30K. What are you buying at that price?

- Intuitive UI

- Better UX

- Robust product and content offering that keeps people on your website.

A “good” website session duration depends on the industry and target audience, but a B2B company should shoot for 2-4 minutes. The only way visitors stay on your website is if there’s something to attract and keep their attention.

More frequent content marketing: Again, you’re boosting whatever works. If you’ve been posting on your company blog once a month, make it twice a month. If you publish a special report once or twice a year, publish a quarterly report.

Add a podcast or a YouTube channel.

Just level up to increase the chances people have to learn about you and what you do.

PRO TIP

How to design a marketing strategy that scales with your fintech company

Whew! That was a lot.

Are your gears turning? Has this sparked your creativity? Good! Here are a few tips to distill all these suggestions to construct a marketing strategy that meets your business needs and attracts your customers.

Focus on your urgent needs. Whether it’s a website, educational material, or figuring out your branding, focus on one thing at a time. Urgency is defined by whatever is top of mind and feels like a bottleneck to your progress.

Consider your budget: one-time vs. on-going services. Don’t fall into the “well this is what it costs if you want to be successful” trap you may hear from agencies and growth hackers. Mature founders know how to manage their money and you shouldn’t spend more than you have coming in.

There are also plenty of one-time services (web copy, brand strategy, and white papers) that help you move the marketing needle. On-going services, like SEO, PPC ads, and content marketing, should only be considered when you can easily manage the monthly or annual cost.

Measure your bandwidth. Even if you outsource (see the next tip), there’s a fair amount of management you and your team will need to take on. Don’t commit to posting and creation schedules that take away all your time from product development, fundraising, building partnerships, and other necessary tasks.

Outsource, my friend. If you are a startup or pre-seed fintech, do yourself a favor and outsource your marketing efforts. You can leverage someone else’s expertise while you test and experiment how marketing actually works for your company.

The monthly or one-time expense will always cost less than trying to DIY the thing or hire someone full time. You’ll have time to build a full team as you scale. And just imagine how thrilled they’ll be to already see your marketing machine up and running!

If you’re interested in building a company that lasts, approaching your marketing strategy in stages ensures that your company growth is steady and lasting.

Find out what your square one is (then two and three) when you call Copy Write Marketing for a free marketing consultation.