The world of fintech is a crowded one. To get noticed, attract clients, and grow your company, you need a stable and scalable marketing strategy. Here are the top fintech marketing trends in 2024 you need to follow to connect with customers.

Before we jump into it, let’s keep this list in perspective.

These are trends driven by consumers: what they want to see, what they need, and what they’ll happily respond to and pay to have. By keeping an eye on trends, concerns like product fit and market viability become less difficult to predict or understand.

They’re also medium agnostic, meaning you can apply them to video, blogs, social, PPC adds… whatever is feasible within your preference and wheelhouse.

As a special fiscal bonus, none of these trends will drain your resources or take your entire marketing budget. They will help you focus what you’re already doing on principles that attract new customers and cement brand recognition (and loyalty).

Without further ado…

#1 Consumer Trust

Handling someone’s money is akin to managing someone’s livelihood. To convince customers to sign a contract and hand over their money, they want to know you are trustworthy. Whether it’s with their data, customer list, or compliance requirements, your customers should know that you will handle their business with care.

Edelman released a survey in 2019 that reported 81% of consumers buy on trust.

Trust, then, is currency to fintechs. It directly translates to:

- Increased conversion rates.

- Customer retention. Remember, it costs less to retain customers than to acquire them.

- Positive business reputation. 93% of consumers say they read reviews before buying.

Building Consumer Trust

Creating this type of brand loyalty isn’t as ephemeral as it may sound. Like any relationship, it’s built on solid communication.

Be transparent!

For example, clearly and frequently talk about security measures and compliance with industry regulations.

Be incredibly thorough with your educational content so your customers feel informed, but also smart for choosing to buy and work with you.

Address issues like privacy concerns and data hacks as they pop up in the news to show consumers how and why you’re different.

Where this pops up in products

Open banking connects several financial activities in one app and contactless payments. It inspires every user to be more knowledgeable and involved with their financial activities.

It also busts open the door to data privacy and cybersecurity concerns. Turns out there’s a price to pay for convenience. It’s the job–nay, responsibility–of every fintech company to earn consumer trust by directly addressing their biggest privacy and security concerns.

It’s not enough to say, “Trust us!” You need to prove it again and again. See what PayPal has done with their Privacy page.

Other privacy pages on PayPal’s website—yes, there are multiple—include this tagline:

Shopping that respects your privacy starts with PayPal.

Simple. Clear. Transparent. Thorough.

#2 Inclusivity

Fintech carries the very real power to equalize the financial playing field by providing equal access to all of its users: young and old, white and black, rich and poor.

Every user knows it, too. Ensuring that your company’s solutions are accessible to a diverse range of users is a business imperative.

Along the same vein of gaining consumer trust, the companies who stand and build behind banners of inclusivity will gain and retain customers for years.

Real Inclusiveness, not holiday posts

And I’m not talking about pandering posts during Hispanic Heritage Month.

Inclusivity in marketing means demonstrating that your product can level the playing field. Either by increasing productivity, understanding, credit scores, or account balances—show that your product can elevate the experience of everyone.

Where this pops up in products

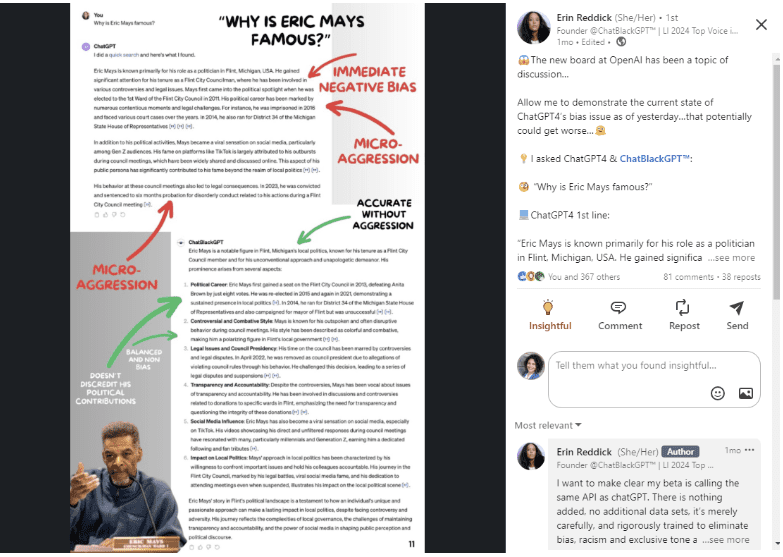

Generative AI is in its very nascent stages of development and it predictably carries the biases and prejudices of its developers.

Enter BlackChatGPT. It’s being developed by Erin Reddick and she’s on a mission to prove OpenAI biases and showcase that it has non-biased capabilities.

In one of her LinkedIn posts, she easily shows ChatGPT’s bias, making many users (especially minorities) trust the product less.

The full potential of AI to innovate fintech can only be realized by addressing the very human issues and biases that are backed into tech.

#3 Generosity

Generosity is a curious cosmic truth. When we’re generous with our time, council, expertise, or worldly goods, we feel great while also making others feel good.

Joey Tribianni was probably right. There are no selfless good deeds.

When it comes to marketing, we absolutely want our generosity to be a two-way road. When we offer anything for free–a consultation call, a white paper, a report, or some other gift–we expect something in return.

Turns out, that reciprocity is really easy for customers to grant once they interact with customers who offer high-value free stuff.

A Marketing Strategy Built on Generosity

For fintech companies, this means focusing on content through blogs, videos, and social media posts. Sharing insider information about your products and the industry will accomplish a few things in the minds of your customers:

- They’ll feel more capable of making a buying decision.

- They’ll feel more savvy navigating the fintech landscape.

- They’ll trust you to provide accurate and practical information.

- They’ll easily hand over their money, email, address, 5-star reviews, and referrals… whatever you ask them to do.

A few marketing examples:

When you’re building out your content library, make sure it’s filled with high-value content and that you post regularly. Recency leads to online credibility.

If you have an in-depth report or survey results to share, ask for an email address to send it to. Doing so builds an email list full of interested, warm leads to pass on to your sales team.

When a client completes an order, send a ‘thank you’ email and ask them for a review. It can be a Google review, a quick customer satisfaction survey, or a general request to share your company’s name with their friends and colleagues.

Where this pops up in products

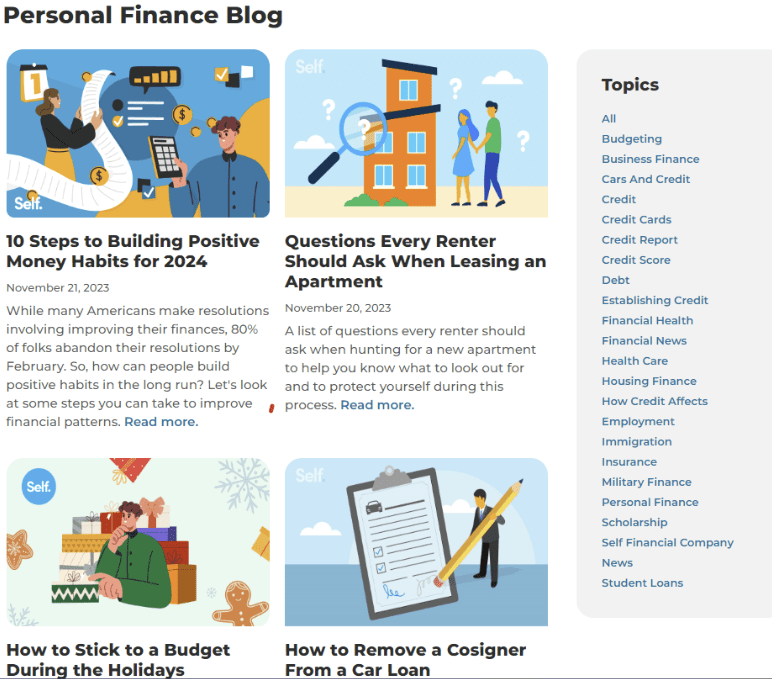

Self Financial helps their customers build their credit score and savings through credit building loans and other credit reporting services.

Their marketing strategy centers around empowerment, helping their customers feel more comfortable and confident with money so they can achieve their big financial goals.

To that end, they have a blog and YouTube channel full of educational content about credit, and financial management. All of this free content reinforces the idea that Self Financial is really in business to help and teach.

#4 Storytelling

One of the biggest hurdles for new or up-and-coming fintech companies is finding a way to stand out. It isn’t through data or even having a superior product. If you want that product to stick out, or rather stick to, customers, you have to connect with them on a human level.

The This Week in Fintech Podcast had an episode with two of the co-founders from Alloy. Tommy Nicholas highlighted the impact of personal standards when creating a product that resonates:

“People underestimate the importance of taste. It ends up making the difference between the great products and the bad products. Why does everyone say that this one’s the best? Taste is the answer like nine times out of 10.”

People respond to stories more than any other method. Think about pneumonic devices to help with memorization. Or this great quote from organization management expert Terrence Gargiolo:

“The shortest distance between two people is a story.”

Stories provide context and answer the question, “But why should I buy from you instead of [insert other company]?”

Storytelling in B2B

Using stories to attract everyday consumers seems obvious, but I get a lot of pushback from B2B businesses.

B2B marketing is seen as more “professional” and doesn’t respond well to whimsy and flashy marketing campaigns. At the end of the day, you’re still selling to people, not businesses.

Great stories will always:

- Focus on the customer’s transformation. How can they turn their frustration, doubt, and fear into ease, success, and confidence?

- Make the customer the hero of their story, not the company they’re buying from. That starts with the opening line of your website and the images you use. Do you showcase how great the customer can be or how impressive you are?

- Connect with a customer’s core values. Whether it’s collaboration, innovation, integrity, or inclusion, when customers feel like you get them, they’ll start to trust you (see point #1).

- Be easy to retell. That means it’s simple and straightforward. Don’t turn your business stories into a Christopher Nolan film.

Where this pops up in products

The easiest way to tell stories is through case studies. They can be as formal as a downloadable PDF and as short as a testimonial. Either way, they connect your product to real people and their real experiences.

Salesforce has an entire page dedicated to Success Stories. There were 75 at the time of this article. They each highlight the unique and relatable problems companies solved by using Salesforce.

Case studies follow this basic formula:

- Customer had a problem that was frustrating or a time-suck or a money-suck.

- Customer found your company because you offer [unique benefit or solution].

- Customer had a great experience.

- End result and overall feeling after working with your company.

Once you have a few success stories, you can publish them everywhere to generate more leads and build customer trust.

Choosing the Right Marketing Investment

Is your brain churning with ways to make your company more attractive to clients? Still not sure where to start?

Square one is always an audit.

- What do you do well?

- What are you missing?

- How current is your material?

- Can you leverage existing material?

- How do you want to grow? What KPIs or outcomes are you targeting?

- What do you need to do to hit those goals?

- What can you afford?

Then you can shift through the marketing options to determine which one will give you the most bang for your buck.

You may settle on making website changes to be more customer-focused.

You may commit to more educational articles that you distribute on your blog, socials, or newsletters.

You may want to try something new like creating short-form videos that also double as educational content or sales materials.

Or maybe you want to try out a targeted PPC campaign to expand your reach and grow your potential pool of leads.

Whatever method you settle on, be sure to weave in these trends to better connect with new customers and build loyalty with the ones you’ve worked hard to get.

A Time- and Money-Saving Solution

Navigating the shifting trends of marketing is a full-time job, but probably not one that you have time to do yourself. Partnering with a marketing agency is a game changer for growing and scrappy businesses.

Here are just 4 reasons why you should work with a marketing agency.

- Leverage agency expertise. Who has time to track and tweak ad campaigns or produce dozens of new content pieces? Agencies do!

- Create data-driven marketing strategies that match your budget and goals. Agencies stay on top of marketing trends and can focus on what works.

- Focus on product development or scaling or connecting with investors while someone else handles your campaigns. Or in other words, focus on your strengths and delegate the rest.

- Save the hire. The starting salary of a digital marketing manager is $123,483. Even if you spend $2,000 a month with an agency, it’s a fraction of the cost of a full-time, in-house marketer.

Wondering if Copy Write Marketing can help you hit your targets this year? Schedule a call to see if we’re a good fit.